Congratulations on your upcoming retirement!

Congratulations on applying for retirement! Your IMRF pension will provide you with retirement income as long as you live.

Topics on this page

(Click the links below to learn more about a topic)

- What should I do first?

- How do I learn more about my benefits?

- What documents should I expect from IMRF?

- Will I receive Social Security as an IMRF member?

- Can I work part-time for an IMRF employer after I retire?

- How can I find health insurance after retirement?

- How is my IMRF pension taxed?

- How can I change my direct deposit account?

What should I do first?

Register for Member Access

If you don’t yet have an IMRF Member Access account, click here to create one.

Options retirees may wish to consider

- Health Insurance Continuation through Employer

For more information about health insurance after retirement and whether you will need to fill out the “Health Insurance Continuation through Employer – Premium Deduction Authorization” form, click here. - Blind Mailings

Click here to learn more about blind mailings. If you would like to remove your name from these blind mailings, log in to your Member Access account to update your communication preferences. You may also call IMRF at 1-800-ASK-IMRF (1-800-275-4673) Mon-Fri, 7:30am-5:30pm CST. - Reversionary Annuity

IMRF’s Reversionary Annuity allows you to choose a smaller IMRF pension and provide someone else in your life with a survivor’s pension when you pass away. This pension is separate from the IMRF’s surviving spouse pension. You can only choose the Reversionary Annuity before your retirement is finalized. Learn more by hovering over the "Members" tab at the top of this page, select your plan and tier, then choose "Reversionary Annuity."

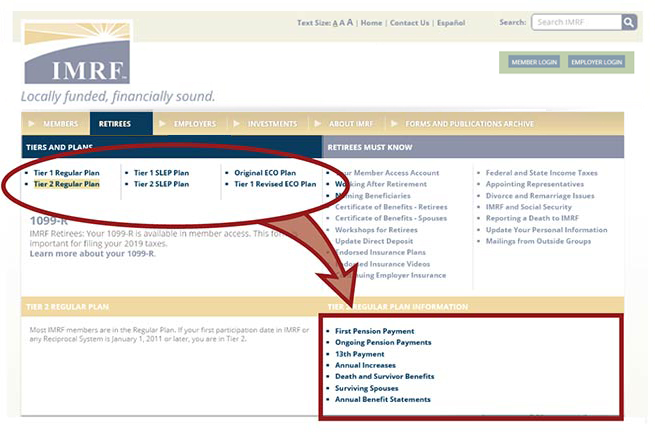

How do I learn more about my benefits?

To learn more about...

- Your first pension payment

- Your ongoing pension payments

- Your 13th Payment

- Your annual pension increases

- Death and survivor benefits

- Surviving spouse benefits

...click on the “Retirees” tab on the menu at the top of the page:

What documents should I expect from IMRF?

Your Preliminary Benefit Statement

If you are eligible to receive a retirement refund or have other choices about your pension, you will receive a Preliminary Benefit Statement explaining your payment options. You should receive your Preliminary Benefit Statement after your claim is approved.

Your Certificate of Benefits

After we process your retirement, you will receive your Certificate of Benefits. Keep this document with your important papers. It includes useful information about your retirement benefits, including:

- The amount of your monthly pension and annual increases

- The effective date of your pension

- An explanation of death benefits for your beneficiaries

- Federal income tax information

Will I receive Social Security as an IMRF member?

The majority of IMRF members are entitled to unreduced Social Security benefits. If you hear differently from a Social Security representative, click here to learn more.

Can I work part-time for an IMRF employer after I retire?

Always contact IMRF first if you're thinking about returning or continuing to work for any public sector employer. You can face serious financial consequences if you don't follow the laws that apply to receiving a public pension while working for a public sector employer.

To ask about your situation, send us a secure message through Member Access, or call us at 1-800-ASK-IMRF (275-4673).

How can I find health insurance after retirement?

Your IMRF benefits do not include insurance. For more information about your options, visit:

(Note: IMRF Member Services Representatives cannot answer questions about insurance benefits.)

How is my IMRF pension taxed?

Your IMRF pension is subject to federal income tax.

If you live in Illinois, your pension is not subject to state income tax. Other states vary.

Form W-4P: Withholding Certificate for Pension Payments

The IRS requires you to complete Form W-4P and return it to IMRF. The easiest and fastest way to do this is through your Member Access account. To log in to your Member Access account or to register for an account, click here.

Form 1099-R: Your annual tax statement

You will receive a 1099-R tax statement from IMRF in the mail every January. It contains information you’ll need for filing your federal and state income tax returns. Your 1099-R statement will be available in your Member Access account before it is mailed to you. You can also view 1099-R statements from earlier years in Member Access.

For more information about how your pension is taxed and the forms you need, click here.

How do I change my direct deposit account?

The fastest and easiest way to submit changes is through your Member Access account. To learn more, click here.