IMRF’s Voluntary Additional Contribution (VAC) program is an easy way to help you save additional retirement income. Voluntary Additional Contributions:

- Are limited to a maximum of 10% of your IMRF reportable earnings.

- Are after tax, not tax-deferred.

- Are a separate individual account consisting only of your contributions and any interest you earn on them. Employers do not make any contributions to your VA account.

- Accrue interest differently than traditional saving accounts.

- Continue to earn interest for as long as they are left on deposit with IMRF

If you reach 40 years of service and choose to stop making IMRF contributions, you must also stop making Voluntary Additional Contributions.

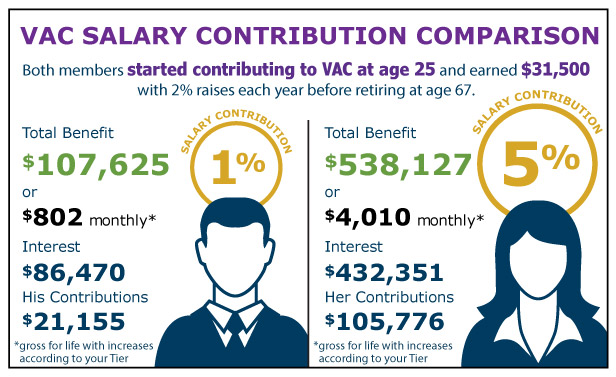

Begin Investing at Age 25–Voluntary Salary Contribution Comparison

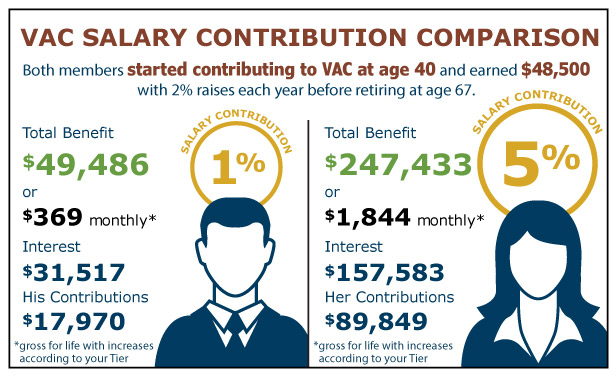

Begin Investing at Age 40–Voluntary Salary Contribution Comparison

How IMRF Credits VAC Interest

VAC interest is credited differently from a traditional savings account:

- A traditional savings account credits interest on the current amount in the account.

- IMRF credits interest annually, at the end of the year based on the previous January 1 balance. That means:

- You will not earn any interest the first year you begin making Voluntary Additional Contributions.

- If you withdraw your contributions at any time during a year, you will not receive any interest on the contributions you withdraw. Contributions must stay in your account for you to receive interest on them. However, you would receive interest on any previously earned interest that remains in your account.

- The current rate of interest is 7.25%. This rate may change in the future. If it does, IMRF may not directly notify you.

| Voluntary Additional Contribution Interest Example | |

|---|---|

| Year 1 January 1 Opening Balance |

$0.00

|

| VA Contributions made during Year 1 |

$400.00

|

| Interest credited on Year 1 December 31 based upon January 1 opening balance of $0 x 7.25% |

$0.00

|

| Year 2 January 1 Opening Balance |

$400.00

|

| VA Contributions made during Year 2 |

$500.00

|

| Interest credited on Year 2 December 31, based upon January 1 opening balance of $400 x 7.25% |

$29.00

|

| Year 3 January 1 Opening Balance |

$929.00

|

| VA contributions made during Year 3 |

$600.00

|

| Interest credited on Year 3 December 31, based upon January 1 opening balance of $929 x 7.25% |

$67.35

|

| Year 4 January 1 Opening Balance |

$1,596.35

|

Retiring with Voluntary Additional Contributions

If you leave your VAC on deposit until you retire from IMRF, at retirement you may choose to receive your Voluntary Additional Contributions as either:

- A lump sum

- A monthly annuity if your VAC balance is $4,500 or more:

- Every January, you will receive a 3% increase on your VAC annuity.

- This increase is calculated on the original annuity amount.

- Employers do not contribute to this annuity.

You can log in to your secure Member Access account and create a pension estimate to review lump sum and monthly pension amounts of your VAC on deposit plus interest to the date of your estimated retirement. You must have VA contributions on deposit to create a VAC pension estimate.

How to Start Making Voluntary Additional Contributions

To start making VAC contributions:

- Complete an "Election to Make or Change Voluntary Additional Contributions" form (Available in Member Access). You will enter the amount you want to contribute on this form.

- Read this Quick Reference Card to learn how to find the "Election to Make or Change Voluntary Additional Contributions" form in the Documents section of your Member Access account. After you produce your form in Member Access, print it out, complete your section, and then bring the form to your employer.

- Your Authorized Agent must also sign this form.

- Your employer will report your VAC to IMRF.

The VAC program is available to all IMRF members -- your employer must allow you to participate in this program.

Your VA contributions:

| Can be left on deposit if: | Can be withdrawn if: | MUST be withdrawn if: |

|---|---|---|

|

|

|

Changing Voluntary Additional Contributions

To change or stop your monthly VAC:

- Complete an "Election to Make or Change Voluntary Additional Contributions" form (Available in Member Access). You will enter the amount you want to contribute on this form.

- Read this Quick Reference Card to learn how to find the "Election to Make or Change Voluntary Additional Contributions" form in the Documents section of your Member Access account. After you produce your form in Member Access, print it out, complete your section, and then bring the form to your employer.

- Your Authorized Agent must also sign this form.

- You can change the amount you contribute at any time. Your employer will begin reporting your new amount with its next available payroll cycle.

Requesting Voluntary Additional Contribution Refunds

To request a VAC refund:

- Return a completed "Request For Refund of Voluntary Additional Contributions" form (Available in Member Access) to IMRF

You must withdraw all of the contributions you made—you cannot take a partial refund. Your employment status determines when you receive your interest. You can request a refund at any time.

If you are still working for an IMRF employer:

- You will receive a refund of your VA contributions only. Your interest must remain on deposit with IMRF until you either retire from IMRF or stop working for your IMRF employer. Interest on deposit will continue to earn additional interest.

- You may choose to continue making future VAC contributions or stop making contributions.

If you no longer work for an IMRF employer:

- You will receive a refund of your VA contributions and all interest earned.

- The interest earned on your VAC is tax-deferred. If you do not roll over your interest directly into an IRA or other qualified retirement plan, IMRF is required by federal law to make a tax withholding of 20% of the interest. If you are under age 59-1/2, you may have an additional early withdrawal tax.

How long will it take to get my refund?

After IMRF has received all the information we need for your VAC refund, it will take approximately eight weeks to process your refund.