Impact of 2023 Investment Return on Employer Funding Status, Employer Reserves, and Future Employer Contribution Rates

February 1, 2024

Executive Summary

This preliminary information is based on unaudited investment return data and projected actuarial information. Finalized information will be available in May 2024.

The estimated 2023 investment return for IMRF is 13.2 %. This return translates into investment gain of approximately $6.7 billion, after investment and administrative expenses. On average, employer accounts were credited approximately 26.7% of net interest and residual investment income on their beginning of the year employer reserve balance. This credit reflects the fact that, as a sponsor of a defined benefit plan, IMRF employers share all the risks and rewards of investment returns.

In the second quarter of 2024, IMRF will present a series of local Employer Rate Meeting Webinars. At these meetings, the impact of year-end financial and actuarial data on IMRF as a whole and its estimated impact on individual employers will be discussed.

Investment Returns

IMRF’s investment returns reflect financial markets over a calendar year. IMRF reports both a market basis return and an actuarial basis return. IMRF’s estimated 2023 investment return on a market basis is 13.2 %. IMRF’s estimated actuarial return is 11.5%, due to the five-year smoothing of investment gains and losses. The actuarial return is used to determine employer contribution rates and actuarial funding status. The actuarial return smooths the recognition of market returns that either exceeds or falls short of the assumed annual actuarial return of 7.25%. Doing this minimizes large fluctuations in employer contribution rates due to market volatility.

Employer Funding Status

In April 2024, IMRF will furnish each employer its annual GASB 68 information as well as GASB 50 footnote information for 2023. This information will disclose both the actuarial and market-based funding status for all plans for their active and inactive members. Annuitant information is included in the GASB 68 report.

Given the positive market returns in 2023, employers should expect the funding status of their plan to increase on both an actuarial and market-value basis and, consequently, 2025 employer contribution rates will more than likely decrease.

Impact on Employer Reserves

By statute, IMRF must debit member and annuitant reserves with 7.25% interest annually on their opening reserve balance amounts (approximately $2.6 billion for 2023).

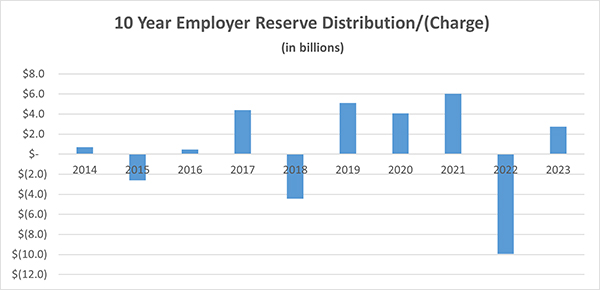

On average, employers will be credited approximately 26.7% based on their beginning-of-the-year employer reserve balance. This credit reflects the fact that, as a sponsor of a defined benefit plan, IMRF employers share all the risks and rewards of investment returns. The actual amount charged to individual employers will vary from the average due to differences in employer and annuitant reserve amounts. Over the last 10 years, IMRF employers have been credited or (charged) the following amounts:

Total Last 5 years = $1.61 billion

Total last 10 years = $0.66 billion

Employer Contribution Rates

Employer contribution rates consist of as many as six parts:

- Normal retirement costs

- Death in service benefits

- Temporary disability benefits

- Supplemental retirement benefits (the 13th payment)

- Amortization of overfunding or underfunding

- Early Retirement Incentives (employer option)

The ongoing cost of the IMRF benefit package for the regular plan, covering normal retirement costs, death in service benefits, temporary disability benefits, and supplemental retirement benefits, was 5.98% of payroll in 2023. Put another way, for each dollar of service an employee renders, the employer also incurs a pension cost of 5.98 cents. If an employer is overfunded, the 5.98 cents is reduced and IMRF draws from the surplus. If an employer is underfunded, the 5.98 cents is increased to collect the shortfall.

Average employer rates for the regular plan over the past five years:

| Year | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Rate | 6.65% | 6.55% | 8.59% | 10.62% | 10.91% |

Individual employer contribution rates vary from the average since each employer has a unique rate affected by its own demographics and funding status as well as a unique mix of Tier 1 and Tier 2 members. Employer rates for 2019 and beyond were impacted by lowering the assumed rate of return to 7.25% as of January 1, 2019.

IMRF Meetings

To discuss the potential impact on individual employers in 2024 and beyond, IMRF will conduct a series of Employer Rate Meeting Webinars in second quarter of 2024. Current topics impacting IMRF and pension plans in general will also be discussed.

Additional details and registration information for the Employer Rate Meeting Webinar will be available on IMRF’s website, www.imrf.org, and in upcoming editions of Employer Digest e-newsletter.

Questions

If you have any questions regarding the information presented in this General Memo, please call or email Mark Nannini, Chief Financial Officer, at (630) 368-5345 or mnannini@imrf.org.