It’s a safe bet that many IMRF retirees and surviving spouses look forward to the month of July. That’s when they receive a supplemental benefit payment, commonly called the “13th Payment,” a benefit provided by the Illinois Pension Code since 1993.

In Illinois, IMRF’s 13th payment is unique among public employee pension funds. So unique, in fact, that it is often misunderstood. Even many of the people who receive the benefit are hard-pressed to explain why. Confusion over the purpose of the benefit has led some to falsely characterize the 13th Payment as a “bonus,” and legislators have at times considered eliminating the benefit. Better understanding how the 13th payment came to be sheds light on both its purpose and the cost of providing it.

Results of the 13th Payment Poll

What do you plan to do with your IMRF 13th payment this year?

In our informal poll we found that most of our retirees use their 13th payment for a practical purpose: to pay their bills.

A Hedge Against Inflation

The 13th Payment exists to reduce the negative impact of inflation on the value of an IMRF pension.

While the current inflation rate is relatively low, it hasn’t always been that way. Inflation topped 10% during the late 1970’s and the early 1980’s. At the time, public employee unions saw that inflation was eroding the purchasing power of its members’ pensions, and successfully lobbied the General Assembly for relief in the form of annual pension Cost-Of-Living-Adjustments (COLAs). Today, most public pensioners in Illinois receive an annual 3% compounding interest COLA , which means their pensions annually increase by 3% of the prior year’s amount. IMRF retirees, on the other hand, received a more modest COLA: an annual 3% simple interest COLA, which means their pensions annually increase by 3% of their original annual pension amount. Over time, the difference between a 3% compound COLA and a 3% simple COLA is significant.

Labor and Management Reach a Compromise

In 1992, representatives from organized labor and local government came together to discuss a way to close the gap between the IMRF COLA and the COLA of retirees from most other public pension systems.

Negotiations went on for many months and included an alphabet soup of organizations. On the labor side of the table were public unions like the American Federation of State, County and Municipal Employees (AFSCME), the Illinois Education Association (IEA), and the Illinois Federation of Teachers (IFT). Local units of government were mainly represented by the Illinois Municipal League (IML).

The groups quickly identified that local units of government did not support compounding the IMRF COLA. This decision was prescient, as today, an estimated 25% of the unfunded pension liability of the state-funded pension systems is attributable to the 3% compounded COLA.

Local units of government did support a compromise that ultimately became the IMRF 13th Payment. Local government agreed to contribute a fixed, 0.62% of payroll annually, to fund the 13th Payment. This funding approach ensured employers’ annual contributions would be stable and predictable.

Employers also insisted that the 13th Payment would cease to exist if IMRF’s simple interest COLA is ever changed to compound interest. This guaranteed that local governments’ contributions to the fund would remain sustainable for their taxpayers.

With concerned parties in agreement, the changes to the Illinois Pension Code were soon codified by the Illinois General Assembly. Complying with the new law, IMRF employers contributed an additional $16 million to IMRF in 1992 to support the 13th Payment. IMRF distributed the funds to eligible members in July 1993 (then as now, an IMRF member had to be retired for at least 12 months to receive the benefit).

The 13th Payment Today

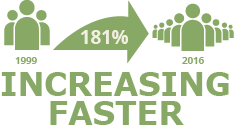

In the twenty-five years since, the number of IMRF employers and their total contributions to the 13th Payment have increased, and so has the number of eligible recipients.

The 13th Payment amount has also steadily decreased from more than 90% of a retiree’s June benefit amount in 1993 to less than 28% in 2018. That’s because the number of retirees eligible for the 13th Payment is growing at a faster rate than employers’ payroll-based contributions. In 2018, the average 13th Payment was a relatively modest $365.

Despite its shrinking size, the 13th Payment makes a difference in the lives of the IMRF retirees who receive it. An informal poll conducted on IMRF’s website in June in 2015 and 2016 asked retirees how they use their 13th Payment each year. The most common response was a practical one: Most retirees use their 13th Payment to help pay their bills.